TechNational is constantly on the lookout for financial products that can simplify and optimize our readers' financial journey. Our finance editorial assistant stumbled upon Save, a savings and investment app, and has put it to the test.

Below is our Join Save App Review, which is written independently and impartially by The TechNational. Please contact hello@thetechnational.com if you would like some more information.

About the Save App

Save presents itself as a game-changer in the fintech space, promising to revolutionize the way users save and invest their money. Founded by industry veteran Michael Nelskyla, Save boasts partnerships with reputable institutions like Webster Bank and Apex Clearing.

Join Save App Review - So How Does Save Work?

Save simplifies the process of saving and investing by seamlessly integrating traditional savings accounts with investment portfolios. Upon sign-up, users create a profile, select a deposit amount and choose an investment portfolio tailored to their financial goals.

Funds are then allocated into a secure, FDIC-insured account at Webster Bank, while simultaneously being invested in carefully curated portfolios through Apex Clearing. This dual approach allows users to earn potentially higher returns on their savings while safeguarding their principal amount.

User experience: Upon downloading the Save app, I was greeted with a sleek interface that guided me through the account setup process fairly seamlessly. From selecting a deposit amount to choosing an investment portfolio, the initial steps were straightforward and user-friendly.

I appreciated the transparency of the platform, which clearly outlined the safety measures in place to protect my funds.

Why Would I Use Save?

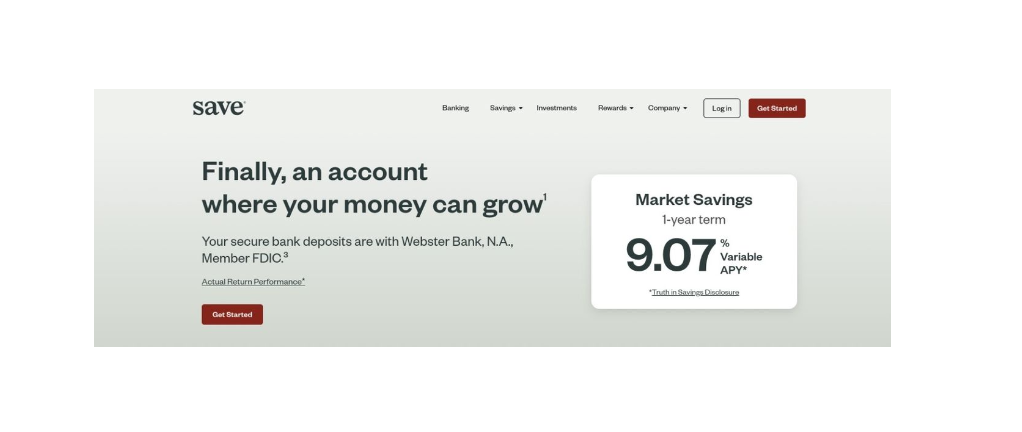

Save offers an attractive alternative to traditional savings accounts by providing potentially higher returns through investment in diversified portfolios. With competitive Variable APYs and the security of FDIC and SIPC insurance coverage, users can grow their savings while mitigating risks.

User Experience: As someone constantly on the lookout for ways to maximize my savings, Save caught my attention because of the potential returns if the market performs well. The prospect of earning potentially higher yields through strategic investments is appealing, while the assurance of FDIC and SIPC insurance coverage provides peace of mind. So even if your selection doesn't perform, you are not going to lose money like you might with backing a stock or share.

The recent video from Save below outlines some of the key benefits of their product:

Are you missing out on free money? Moving your savings to a new account to help you earn more. Then there are programs like Market Savings that combine FDIC-insured deposits3⃣ with variable APYs* of 9.49% for a five-year term. Learn more: https://t.co/uZc5INNpLx pic.twitter.com/1Az562ai22

— Save® (@save_join) September 26, 2023

How Do I Open A Save Account?

Opening a Save account is a straightforward process. Users can sign up through the Save app, providing basic information, selecting a deposit amount, and choosing an investment portfolio. After account approval, funds are deposited into the designated Webster Bank account, and investments are initiated in the selected portfolio through Apex Clearing.

You Can Get Started Opening a Save Account Here >>

User Experience: Opening a Save account was a breeze. Within minutes, I had completed the necessary steps to set up my account, select a deposit amount and choose an investment portfolio tailored to my financial goals.

These included the following:

- Save ESG Portfolio – “The ESG portfolio utilizes the same investment techniques as the Save Global Diversified Markets portfolios and maintains a similar global multi-asset class approach, while utilizing ESG-focused ETFs where possible and avoiding certain assets.”

- Save Global Multi-Strategy Portfolio – “The Global Multi-Strategy portfolio seeks to generate returns across market regimes by combining 6 sub-strategies, built using a cutting-edge quantitative approach that exploits how financial markets respond to themes and patterns, or ‘narratives’.”

- Save US Macro Portfolio - “The US Macro portfolio seeks to generate returns by allocating across asset classes using macroeconomic variables such as interest rates, inflation and the US dollar. This portfolio focuses on the US equity and bond markets, along with commodities.”

- S&P 500 Risk-Controlled Portfolio – “The S&P 500 Risk-Controlled portfolio follows the S&P 500 Index, and adjusts the level of exposure upward or downward daily to maintain a stable level of volatility.”

Source: Save

How Much Does The Join Save App Cost In Fees?

Save doesn't charge any fees specifically to simply open an account, there are certain fees involved with maintaining and using your account. The fees include a small management/advisory fee of 0.20% for Market Savings (Market Trust and Market+ have other fee structures), which is applied to the investment programs when there's an APY above 0.20%.

Is There A Way To Contact Save?

User Experience: Throughout my journey with Save, I found comfort in knowing that help was just a phone call or email away. Users can reach Save's customer support team via phone at 254-284-Save (7283) or through email at support@joinsave.com.

Customer service is available Monday to Friday from 9 a.m. to 5 p.m. CST, ensuring prompt assistance whenever needed.

Is The Join Save App Safe To Use?

Safety and security are paramount concerns for any financial platform, and Save takes these concerns seriously. With FDIC and SIPC insurance coverage, users can trust that their funds are protected against unforeseen risks.

Additionally, Save's partnerships with reputable institutions underscore its commitment to safeguarding users' funds and ensuring a secure and reliable experience.

Save App Review - What is Our Verdict?

Save certainly offers a range of impressive features, including competitive Variable APYs and transparent fees. We will need to wait to see how our investment progresses with Save, and we'll keep readers updated on our returns.

However there are some important drawbacks we should note. Investing carries risks, potentially resulting in returns lower than advertised and fees for early withdrawal. While your initial deposit is secure, the end result may not surpass that of a traditional savings account.

Therefore, depending on your goals, consider the tradeoffs carefully when choosing between Save and traditional savings options.

Pros and Cons

Pros:

- Competitive Variable APYs offer potential for higher returns on savings

- Transparent fee structure ensures users only pay when they see tangible returns

- FDIC and SIPC insurance coverage provide peace of mind for users' funds

Cons:

- Investing carries inherent risks, with potential for returns lower than advertised

- Fees may apply for early withdrawal of funds

- End result may not surpass that of traditional savings accounts

- Not many reviews on Trustpilot for join save app reviews

Rating: 9/10

Some of the products featured may be from partners who compensate us. This doesn't influence our evaluations or reviews. Our opinions are our own. Any investing information provided on this page is for educational purposes only.